We’ve been hearing a lot in the news lately about unprotected servers and emails. Just this past week, a government report showed that the IRS has been using cloud technology for the past seven years without a cloud strategy. Why should we care? Because without a cloud strategy, our federal tax information could be at risk. The same could happen to your business.

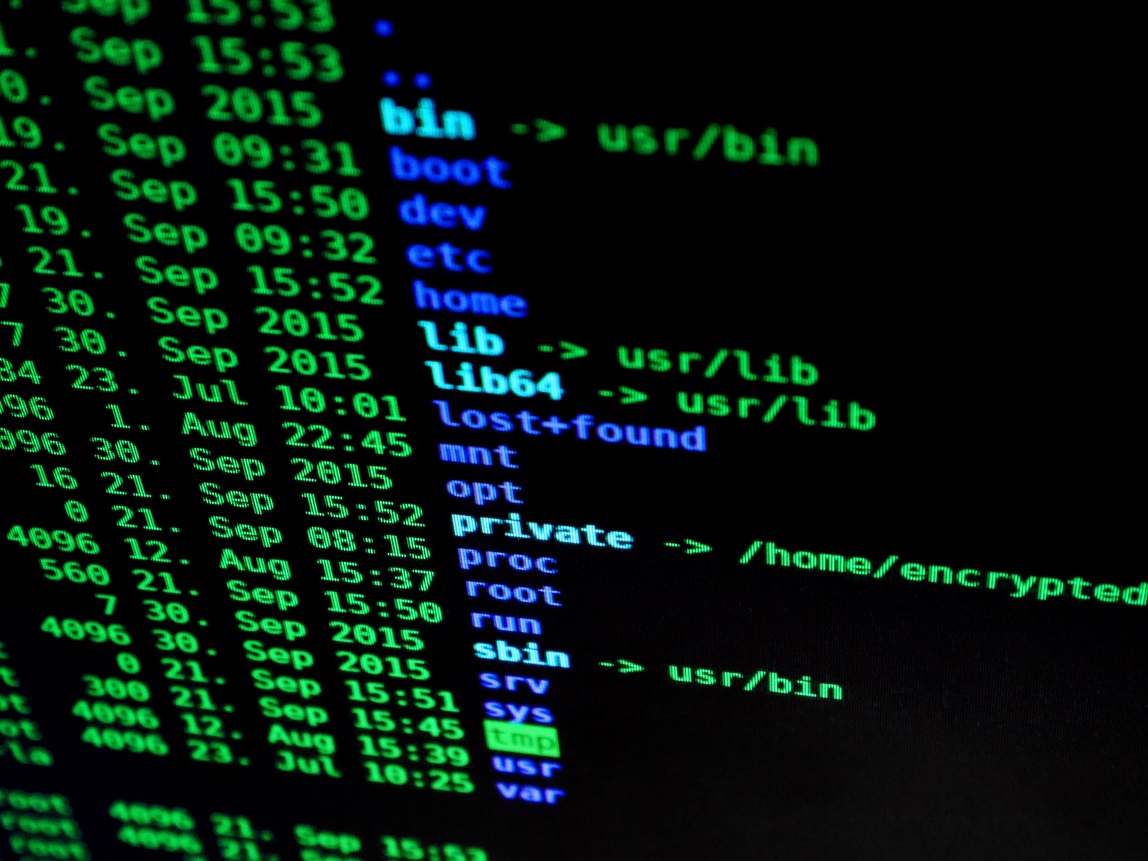

Is your cloud-based information safe? Thieves are targeting computers and holding information for ransom. How do they do it? They’re using ransomware. Ransomware is a malicious software that computer users accidentally download. It locks up your computer and says you have to pay a ransom to get back the use of your computer and information. The ransom is usually a couple hundred dollars, so people end up paying it.

Paying ransom is the bad news, but if you get hacked, could there be a benefit from it? Turns out there could be. You might be able to write off a ransom or hack attack. Here’s how:

- REPORT IT – If you had to pay a ransom to get your own stolen information back, make sure you report it to the authorities immediately. The FBI says ransom payouts could total a billion dollars this year. That’s because computer experts say there are close to 200 ransomware programs out and a huge criminal network out there trolling people’s personal information.

- TAKE A TAX DEDUCTION – Believe it or not, you might be able to write off a hack as a personal or business expense. The IRS allows it in cases of theft, such as blackmail and burglary. If you have to go to court because of a ransom theft, your legal fees can also be written off.

- CONSULT AN EXPERT – Before you take any kind of tax deduction, make sure to ask your accountant or bookkeeper whether the deduction is considered personal or business. The IRS allows for “ordinary necessary and reasonable” expenses to be deducted on your taxes, but if you’re not sure, e-mail or call us here at Brigade Bookkeeping and we’ll give you the right answer.

Protecting your business in the cloud is just as important as making sure the front doors are locked. Now more than ever, criminals want to target your business or your personal finances. Protect them now, but if you do get hacked, make sure you learn from your mistakes and take the deduction.